Optimizing DC-DC converter stability: AC and transient analysis in simulations of source impedance effects

Learn how to optimize DC-DC converter stability through AC analysis in the frequency-domain and transient analysis in the time-domain

The ongoing effects of COVID-19 have had a dampening effect on military R&D programs, indicating that 2022 will see more military and aerospace electronics spending earmarked for legacy defense programs and block upgrades rather than for new platform development.

By John Sturm, Global Vice President of Aerospace and Defense Business

The effects of COVID are hard to underestimate: During the peak of the first and second surges, significant dollars were diverted from R&D and programs to building field hospitals and otherwise fighting the pandemic. Rather than committing to long-lead upgrades in an environment where it may have been difficult to procure parts, the U.S. Department of Defense (DoD) recommitted dollars to older programs and then started specifying requirements for future designs that are essentially skipping a generation.

There are some exceptions, however. One is the continued development of intelligence, surveillance, and reconnaissance (ISR) technology, which we expect will reach $63 billion by 2026, growing at a 6.2% CAGR [combined annual growth rate] – more than twice the rate of global military spending rates. These ISR platforms require higher power density and more total power so that they can operate over longer ranges and at higher resolution, whether used in a line-of-sight or non-line-of-sight deployment. We’ll also see new ISR technology deployed across a variety of platforms both manned and unmanned; these platforms can gather intelligence and collect data in places where it’s too dangerous to send personnel.

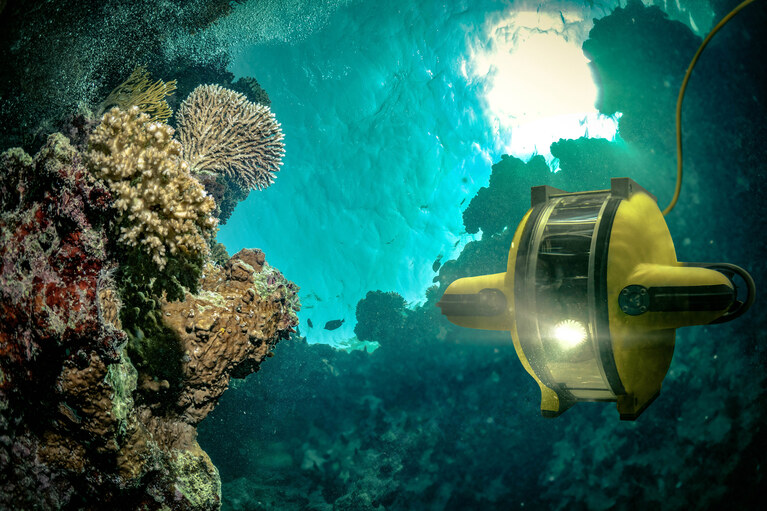

Unmanned vehicle development will also continue to expand at an increased rate: This growth will include aerial, ground, and amphibious vehicles for ISR; offensive and defensive weapons; and practical work. This unmanned vehicle market is estimated to reach nearly $17 billion by 2027, a CAGR of 7.9%.

In fact, those efforts in the unmanned arena are spawning a countertrend in the areas of radar and laser development. From a power and cost perspective, it’s more efficient to target and train a laser on a small drone or unmanned aerial system (UAS) rather than to intercept it using an expensive missile (from $100,000 to $1 million). Vicor expects radars and laser weapons will grow at a 7.5% pace through 2026, to a market size of about $24.5 billion. This growth will be driven by adding systems such as targeting lasers, defensive lasers, radar systems for defensive and offensive surveillance, and communications and encryption on existing platforms to add more features and capability

As the world continues to grapple with the challenges imposed both by the COVID-19 pandemic and the ever-present concerns over global economy and security, these are among the applications that Vicor expects will represent the biggest areas of growth and R&D investment in the year ahead.

This article was originally published by Military Embedded Sytems.

John Sturm joined Vicor in 1997. He has over 33 years of experience in Electrical Design Engineering, Engineering Management, Business Development, Sales, and Sales Management. In his current role he is focused on leading the company’s business in the Aerospace and Defense Market while developing key partnerships with Prime contractors in the Industry. Prior to Vicor he was with TDK Corp. of America, and Grayhill Inc. John holds a B.S. Degree in Electrical Engineering from the Illinois Institute of Technology, and an M.B.A. from the Lake Forest Graduate School of Management.

John Sturm, VP of Aerospace and Defense Business Unit

Rugged, efficient, high-power solutions enabling longer missions and advanced defense capabilities

Webinar: Meeting DC-DC power system requirements in defense applications

Case study: Aircraft gets an 11kW power supply the size of a tablet computer

Case study: Electric-powered aviation with high-efficiency, scalable power components

Optimizing DC-DC converter stability: AC and transient analysis in simulations of source impedance effects

Learn how to optimize DC-DC converter stability through AC analysis in the frequency-domain and transient analysis in the time-domain

Power under pressure: Meeting the military’s surging energy demands

More capability (power) and compatibility are in demand for military power system designers. Learn how the Vicor SOSA Power Supply solves this problem

Providing well-regulated 48V at over 1kW

Learn how Vicor delivers power at 1kW with efficiency and reduced weight

Reducing I2R losses to enable extended missions

Learn how Vicor delivers high power with efficiency and reduced weight for electronic countermeasures